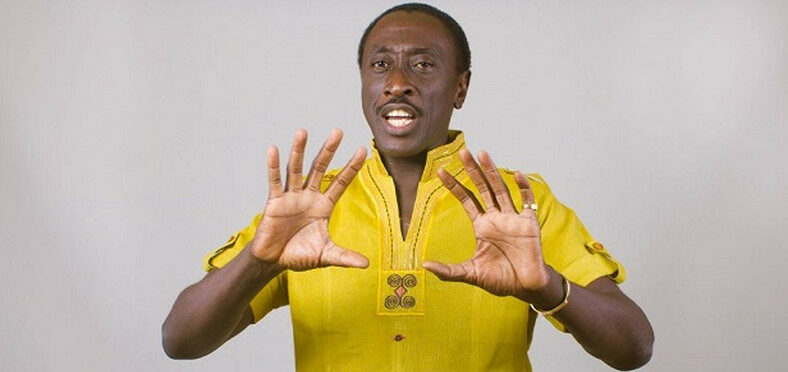

Popular Ghanaian satirist and veteran broadcaster Kwaku Sintim-Misa (KSM) is calling for greater government accountability following the introduction of Ghana’s new GH¢1 per litre fuel levy. In a message directed at Finance Minister Dr. Cassiel Ato Forson, KSM urged quarterly public disclosures detailing how funds from the levy and similar taxes are being collected and spent.

KSM emphasized that most Ghanaians are not opposed to taxation in principle but grow skeptical when officials fail to provide clear updates on how public money is used.

“No Ghanaian I know is afraid to pay taxes. They are only hesitant because they don’t know what politicians do with the money. Tell them, ‘this is how much we are getting from the levy, this is how much we have spent and where we have spent the money.’ Let it not be on paper; let it be transparent,” he said in a video posted on YouTube.

His comments follow Parliament’s recent passage of the Energy Sector Levy (Amendment) Bill, 2025, which introduced the GH¢1 charge on each litre of fuel sold. According to the Finance Ministry, the policy is designed to help clear over $3.1 billion in energy sector debt as of March 2025 and to guarantee a reliable electricity supply.

READ ALSO: Captain Planet Backs GH¢1 Fuel Levy, Tells Ghanaians To Prioritize Progress Over Politics

Officials estimate that the levy will raise GH¢5.7 billion annually, intended for paying arrears, reducing legacy debt burdens, and securing fuel for power generation.

But while the government argues the tax is a necessary move to stabilize the energy sector, it has drawn backlash from civil society groups. Critics argue that the levy risks exacerbating living costs, especially in a fragile economic climate where transport and commodity prices are already strained.

Opponents warn that even a modest hike in fuel prices can trigger inflationary ripple effects across the economy, worsening the financial burden on ordinary citizens.

KSM, however, believes the public’s willingness to comply with such measures hinges not on the amount charged, but on how openly the government explains where every cedi goes.